Over the past decade, we have noticed that nearly all retirement income plans have the exact same problems. Failing to recognize these mistakes before retiring could create significant financial obstacles in your retirement outlook.

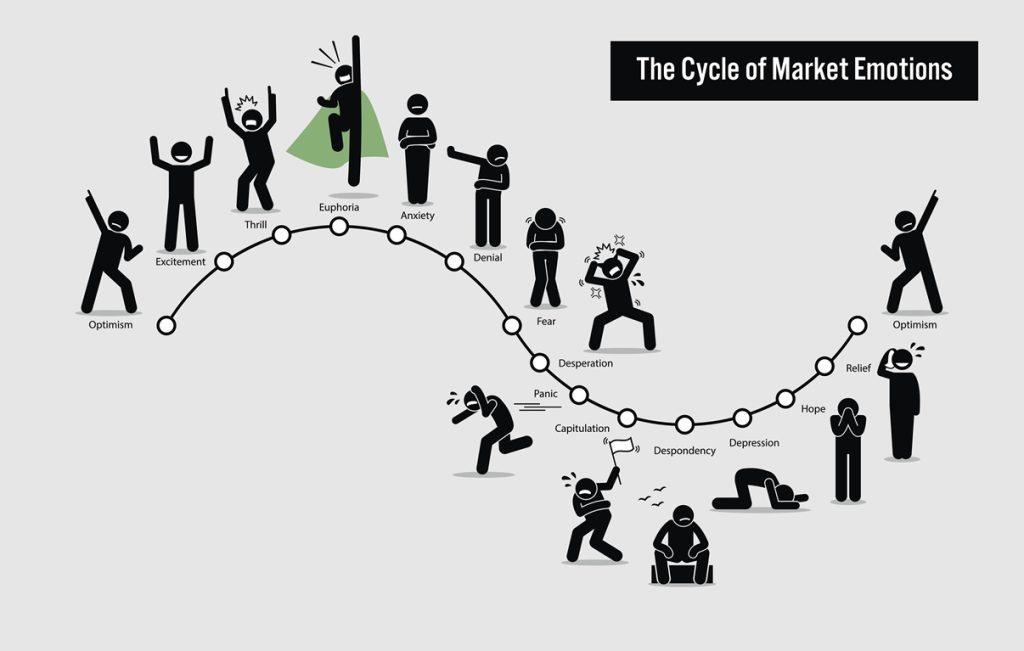

- Hoping & Assuming that the market will always work in your favor over the course of a 25-30 year retirement. The markets have dropped 50% twice in the last 22 years and even experienced a 13-year period with zero growth. If you have failed to consider how these types of real-world conditions could affect your retirement, it is unlikely your investment assets will be able to sustain long-term retirement income distributions.

- Failing to Understand that the concept of “diversification” has changed drastically over the past decade. Over the past two decades, we have seen multiple time periods when both stock and bond markets fell at the same time, offering traditional balanced portfolios little protection from severe volatility. Understanding the reasons why this happens and how to protect your retirement assets under similar conditions will likely be critical.

- Disregarding the historical shifts in monetary policy since the financial crisis in 2008-2009 and how they have directly affected the financial markets. Taking into account the remarkable influence of interest rates and quantitative easing on the global financial system has been and will likely continue to be essential in long-term planning.

- Failing to Account for all of your income sources and knowing how to calculate a realistic target income objective throughout retirement. Taking distributions that are too large or even too little within the first few years of retirement can be highly detrimental to a retirement income plan. Decisions that you make early on in retirement will have amplified effects on your outlook due to those decisions being the foundation of a 25+ year retirement. Being certain that these initial decisions are appropriate for your long-term objectives is critical to the sustainability of your retirement.

- Locking yourself into a plan that allows little-to-no flexibility to adjust for changes in the markets and your retirement lifestyle. Having a retirement income plan that can be easily amended and updated for unexpected developments is especially important in today’s market conditions. Limiting the flexibility of your retirement income plan can be extremely costly in the event of significant shifts in market conditions or unintended changes in your retirement circumstances.

- Investing without Knowing precisely how each and every single investment you own will function within your retirement income plan. You must understand how each asset that you are relying on for retirement income will meet a specific objective within your plan. We insist on our clients having a very detailed understanding of our recommendations and how each segment of their retirement income plan has a specific purpose to support their long-term income objectives. Being properly and thoroughly educated on your retirement income plan and how it will operate in all market conditions is crucial.

- Misunderstanding the difference between low-risk and principal-protected can mean the difference between your retirement assets providing the income that you need throughout retirement and your retirement assets being completely depleted. A realistic and efficient retirement income plan should balance practical growth rates, appropriate risk tolerances, and clearly define the difference between low-risk income and guaranteed income sources.

- Procrastinating or completely neglecting to update and analyze your retirement income plan is a very common mistake. Designing and implementing a retirement income plan is only the first step; you must update your account balances and distribution rates on a regular basis (at least once per year) to properly maintain your income plan. You will be surprised at how much better you understand and appreciate your retirement income plan when it is brought up to date on a consistent basis. Having a clear, but detailed, overview of your retirement income outlook that can be updated or amended as needed will help put your mind at ease. Failing to update your income plan regularly renders your initial efforts nearly irrelevant.

- Forgetting to calculate how much of a married couple’s gross income would be lost in the event of one spouse passing away. Although the surviving spouse may be eligible to retain their deceased spouse’s social security benefit, the lower of the two social security benefits will discontinue immediately. Furthermore, when one spouse passes, this can reduce or eliminate pension income that the couple may have been receiving. Planning ahead for how to account for such significant reductions in retirement income is rarely considered.

- Neglecting to set up state and federal tax withholdings on your taxable income sources and to proactively plan for required minimum distributions. We have met many individuals and couples who only take distributions that they need for spendable income and fail to pay their tax liability until the following year, requiring further distributions. This can lead to significant increases in your annual tax liability and possible penalties. It is also very important to analyze your required minimum distributions years in advance so that you have determined the most efficient way to maximize these funds for income or future beneficiaries.