Without question, the number one mistake we see with 99% of retirement income plans is failing to take into account how drastically the financial system has changed in the last two decades.

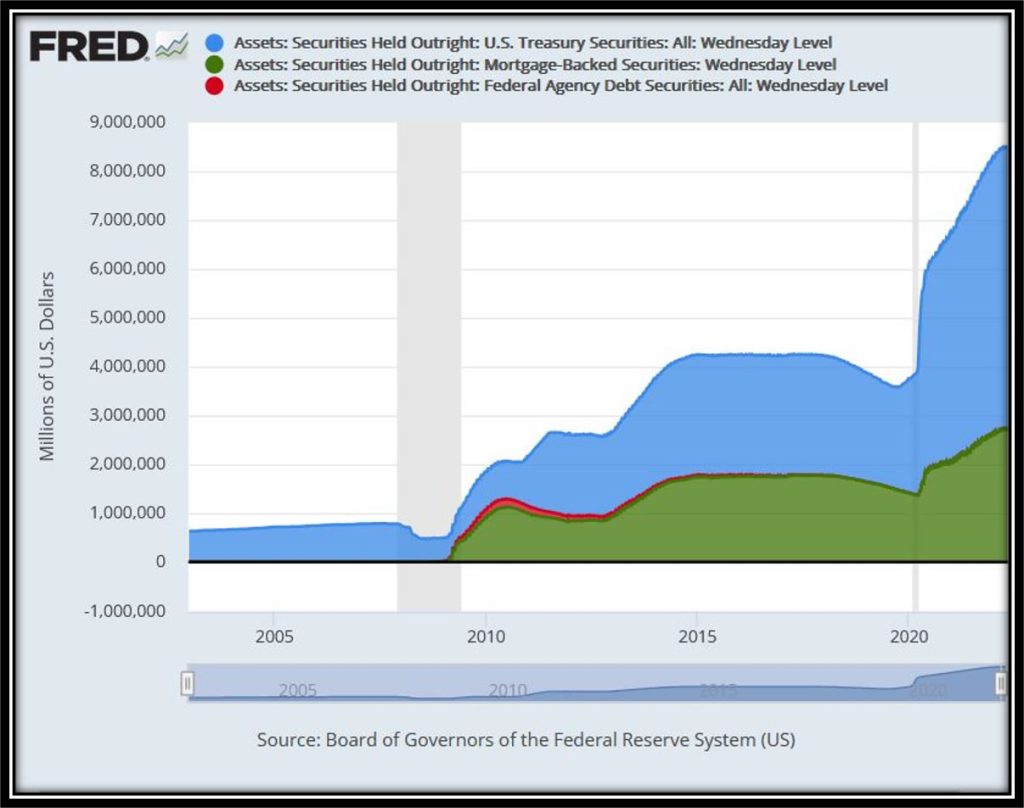

Monetary and regulatory policy has drastically reshaped how the financial markets function, and recognizing these differences is essential when designing a retirement income plan. We have found that very few, if any, retirement planning models take into account the historic shift in interest rates, the highly active role of the Federal Reserve in the marketplace, or the structure and risks associated with an ultra-complex system of debt, leverage, technology, and policies that cause the markets to function in its current form. Ignoring these complexities does not make your retirement income plan immune to them, it simply means that your income plan has not accounted for the risk associated with these concepts.

The first section of our retirement planning course offers an in-depth look at the complex dilemmas of the modern financial system to provide retirees a genuine understanding of the unique factors associated with retiring in the 21st century. It is up to each individual to decide if these varying factors are relevant to their retirement or if they should be accounted for in their income plan. However, it is our opinion that these concepts are not only critical to retirement planning, but to each and every investor who is wanting to maximize their long-term financial objectives. It is also our opinion that the past decade has severely impacted investors’ expectations of what is and is not realistic in terms of long-term growth rates. Everyone wants to expect the best and financial advisors want to present the best-case scenario, but this is not likely to end well. This is why we insist on looking at real-world examples of the best, worst, and most realistic possible outcomes for your retirement income planning objectives. The following is an abbreviated list of the questions that we consider when analyzing your plan.