- Retirement Income Planning The core focus of our practice is designing, implementing, and maintaining long-term retirement income plans. Essentially, we are analyzing how best to maximize and protect your income objectives throughout the duration of your retirement. Are you taking the right distribution from the right account in the right amount at the right time? Are you properly accounting for market volatility, required minimum distributions, the risks associated with your investment assets? These are just a few examples of the factors you need to consider when analyzing a retirement income plan for the next 25-30+ years. Having a realistic, efficient income plan that you genuinely understand and that can be amended as-needed is absolutely essential under current market conditions. The phrase “failing to plan is planning to fail” definitely applies to retirement income planning, and not having a thorough understanding of your income sources can allow your financial circumstances to change drastically when you least expect it.

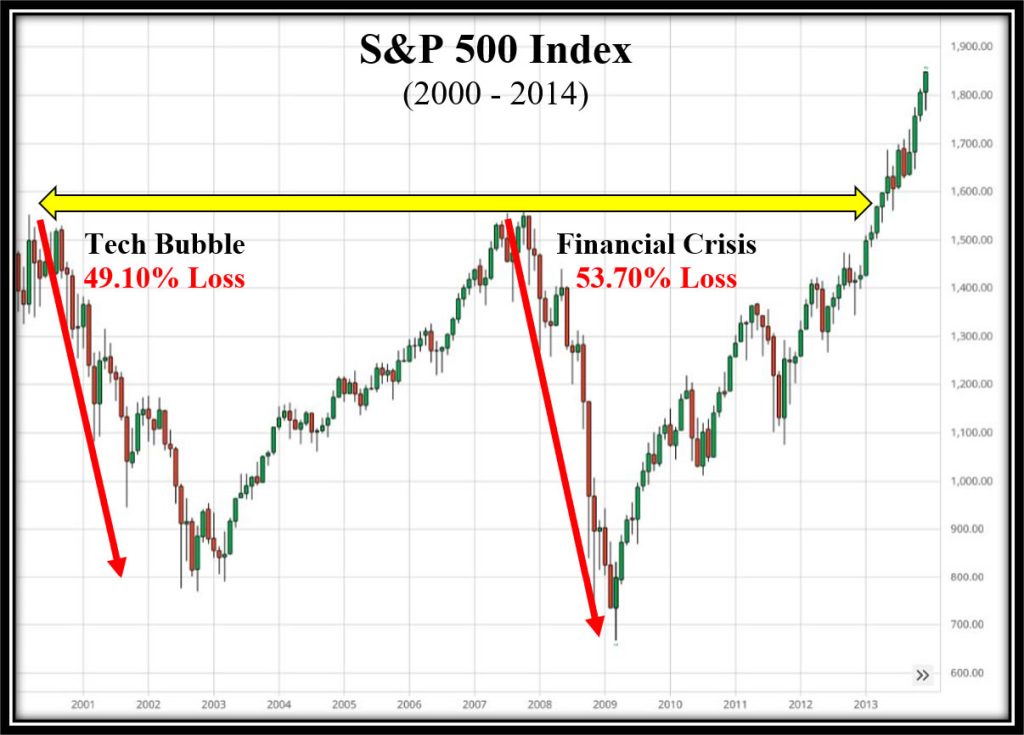

- Investment Analysis & Management If you plan on taking distributions from your assets invested in the stock market for the next several decades, it is imperative to have extensive analysis of how this is going to be done. The vast majority of those that we meet with have unrealistic expectations of market growth, do not understand market conditions, and fail to recognize how one moderate loss in an investment account while taking distributions can have a compounded effect for the rest of their life. It has been our experience that most financial practices present an “ideal scenario” when presenting your financial outlook so that you are more likely to purchase their products or services. We will present a candid assessment of how realistic your objectives are under good and bad market conditions and allow you to decide if you are comfortable with how we recommend managing both scenarios.

- Maximizing Social Security & Pension Income The very first step in retirement income planning is being certain that you have maximized your social security and pension benefits. Unfortunately, both of these tend to be exceedingly difficult to understand, but we can easily assist you in determining how, when, and why to file for your social security and/or pension benefits. Once you file for your social security and/or pension benefit, you are generally locked into the choice you selected indefinitely, so you must be confident that you have selected the right option.

- Required Minimum Distribution Analysis A commonly overlooked aspect of income planning is factoring in your required minimum distributions as mandated by the IRS. Failing to take the correct distribution in the right year can lead to significant tax penalties, and taking your RMD from the wrong source can result in even worse scenarios. We can assist you in making sure that you are taking the correct distribution from the right accounts and maximizing the long-term use of qualified funds. In our opinion, long-term planning for required minimum distributions is one of the most commonly ignored aspects of retirement income planning. If managed correctly, you could easily turn the dilemma of RMDs into another tool that can be utilized to preserve your retirement.

- Legacy & Generational Planning In recent years, there has been a significant increase in the number of ways to maximize the assets that you intend on leaving to beneficiaries. Unfortunately, most of these strategies are expensive, highly complicated, and result in complex tax dilemmas for your heirs. Needless to say, this is not ideal for you or your loved ones. If you are looking to maximize assets that you plan to leave to beneficiaries, there are simple, highly effective ways to do so other than just life insurance. Purchasing life insurance policies when you are nearing retirement can be very costly at a time in life when you are looking to reduce your expenses. Given the number of alternative solutions available, there is likely a more cost-efficient strategy to consider.

Source: www.barcharts.com

(See About ARP for the other two time periods when the S&P 500 went up to 25 years without new growth.)